Mortgage Rates Today: Unlocking New Possibilities for 30-Year & Refinance

Title: Mortgage Rates Just Hit a New 2025 Low: Here's Why That's HUGE

Alright, everyone, buckle up. I know, I know – mortgage rates aren't exactly the sexiest topic for a Tuesday morning. But trust me, what's happening right now in the housing market is a signal of something much, much bigger, a shift that could ripple through our entire economy and beyond.

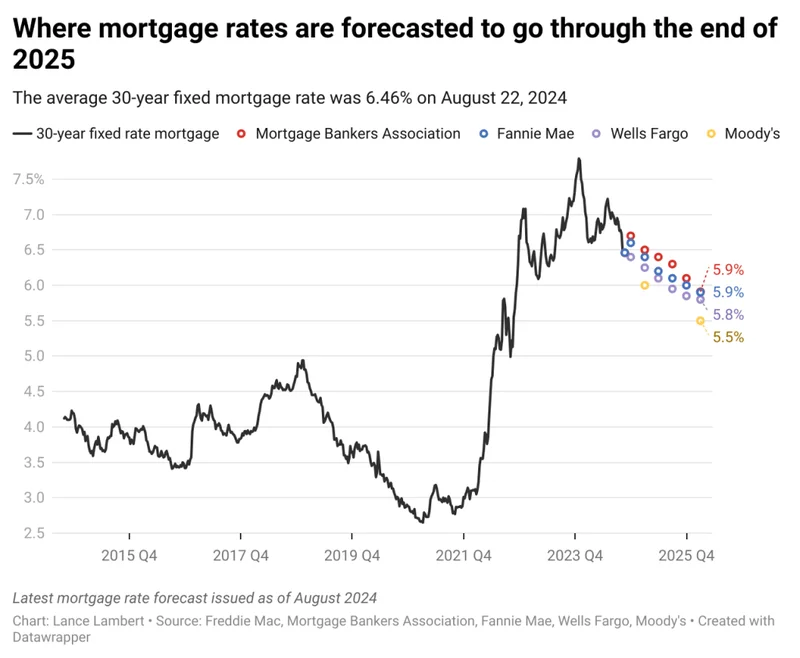

The headline? 30-year fixed mortgage rates have just touched 6.06%, tying the lowest we’ve seen all year. Yes, you read that right. After months of stubbornly high rates, we're seeing a real, tangible dip. And while economists might hem and haw about basis points and Federal Reserve meetings, I'm here to tell you why this seemingly small change is actually… well, huge.

A Glimmer of Hope, A Sign of Change

Think of the housing market as a giant, complex machine. Interest rates are the oil that keeps it running smoothly. Too much friction (high rates), and everything grinds to a halt. Too little (remember those crazy 2% rates?), and things overheat, leading to bubbles and instability. Finding the sweet spot is the key, and 6.06% might just be a sign we're getting closer.

Why? Because it's about more than just buying a house. It's about confidence. It's about people feeling secure enough in their jobs, in the economy, to make a massive, decades-long commitment. It’s about unlocking pent-up demand. Remember all those folks who put their home-buying dreams on hold, waiting for rates to drop? They’re starting to come back into the market, and that creates momentum.

I saw a comment on Reddit the other day that really resonated: "Finally! Maybe I can actually afford that fixer-upper I've been eyeing." That's the feeling. That's the human impact.

And speaking of impact, let's talk numbers. A $400,000 mortgage at 6.06% versus, say, 7% saves you thousands of dollars over the life of the loan. That's money that can go back into the economy – into small businesses, education, travel, you name it. It's a virtuous cycle.

But here's where it gets really interesting. The Fed has already cut rates twice this year, including at its latest meeting on October 29, and the CME FedWatch tool is predicting an 85% chance of another cut in December. What happens if that cut comes to fruition?

Imagine a snowball rolling downhill. Each turn, each revolution, adds more snow, more momentum. That’s what we could be seeing here. Lower rates spur more home buying, which stimulates construction, which creates jobs, which boosts consumer spending… and on and on. It's a self-fulfilling prophecy of growth.

Now, I know what some of you are thinking: "Aris, you're being too optimistic. There are still plenty of challenges – inflation, geopolitical uncertainty, Trump firing the Bureau of Labor Statistics commissioner after a weak jobs report back in August." And you're right. We're not out of the woods yet.

But I truly believe this small dip in mortgage rates is a sign that things are moving in the right direction. It's a testament to the resilience of the American economy, to the ingenuity of our entrepreneurs, and to the enduring human desire for a place to call home.

Of course, we have to be responsible. As rates fall, we need to ensure lending practices remain sound and that we don't repeat the mistakes of the past. Easy money can be a dangerous drug if not handled with care. We need education, responsible lending, and a focus on long-term financial health, not just short-term gains.

What does it all boil down to? It’s a question of affordability. As one article pointed out, the average mortgage interest rate on a 30-year term is 5.99% as of November 24, 2025, according to Zillow. The average rate on a 15-year alternative is now 5.37%. With rates here under 6%, both buyers looking for the conventional 30-year term and others looking to save on interest and expedite their payoff timeline may find an affordable way to do so. What are today's mortgage interest rates: November 24, 2025?.

So, What's the Big Deal?

This isn't just about lower payments; it's about unlocking human potential. It’s about dreams becoming reality. It’s about building a future where homeownership is within reach for more people, and the economy thrives as a result. And that, my friends, is something to get excited about.